Introduction

Buying a home is an exciting process, but it’s also a complex one with many moving parts. One of these key components is escrow, a process that often leaves homebuyers with questions. Escrow accounts offer borrowers a sense of security by ensuring that property taxes and homeowners insurance are paid on time, preventing penalties and potential liens against their homes. However, with this convenience comes unique challenges, such as managing potential payment fluctuations due to property tax or insurance adjustments. To understand this process fully, let’s take a closer look at escrow and how it can contribute to a smooth homebuying experience.

What is Escrow?

Escrow is a financial arrangement where a third-party account established by a lender is used to collect and disburse payments for property-related expenses, typically property taxes and homeowners insurance. This setup ensures that essential homeownership expenses are paid on time. These “accounts became more common after the Great Recession of 2007-09. That crisis had been triggered by a collapse in the real estate market, which had been caused, in part, by overextended homeowners who were unable to pay their taxes and insurance premiums. For the protection of everyone — lenders, homeowners, municipalities and insurers — a newly created government agency, the Consumer Financial Protection Bureau (CFPB), established guidelines for escrow accounts.”

As a result, lenders now often require escrow accounts as part of mortgage agreements, especially for borrowers with lower down payments, to minimize the risk of unpaid taxes or insurance that could otherwise jeopardize the property and the loan.

How Escrow Works

As mentioned, many lenders require an escrow account when you secure a mortgage. It’s like a dedicated savings account but managed by your lender. Every month, a portion of your mortgage payment flows into this account. This money isn’t used to pay down your principal or interest; instead, it’s set aside to cover expenses like property taxes and homeowners insurance.

Lenders want to protect their investments. By collecting these funds upfront, they guarantee that your property is insured and your taxes are paid on time. This reduces the risk of default and safeguards their financial interests.

The process is straightforward. Your lender estimates your annual property tax and insurance costs. This amount is divided by 12, and the resulting figure is added to your monthly mortgage payment. Throughout the year, your lender pays your property taxes and insurance premiums directly from your escrow account, eliminating the need for you to pay them in a lump sum.

While it may seem like an extra layer of complexity, an escrow account offers several advantages. It simplifies your financial life by spreading out significant annual expenses into smaller, manageable monthly payments. Additionally, it ensures that these crucial payments are made on time, avoiding late fees and potential penalties. The lender also recalculates the escrow account annually to adjust for any changes in property taxes or insurance premiums, which can cause fluctuations in your monthly mortgage payment.

Escrow Shortages and Overages

While escrow accounts offer convenience and peace of mind, they also present potential challenges: escrow shortages and overages.

An escrow shortage occurs when your lender doesn’t have enough funds in your account to cover upcoming property tax or insurance payments. This can happen due to various reasons, including increased property taxes, higher insurance premiums, or insufficient monthly payments. If you face a shortage, you’ll likely receive a notice from your lender requesting additional funds to cover the shortfall.

Conversely, an escrow overage (also known as a surplus) happens when your account accumulates excess funds. This can be the result of a decrease in property taxes or insurance premiums or overpayments on your mortgage. While having extra money in your account may seem beneficial, it’s essential to remember that you’re not earning interest on these funds.

Any changes to your escrow account can affect your mortgage payments, so be prepared for potential shortages or overages. To stay informed, monitor your property taxes and insurance premiums regularly and review your escrow statements, as well as your monthly mortgage statements, to ensure that your payments cover your estimated annual property tax and insurance costs.

Understanding Escrow Statement

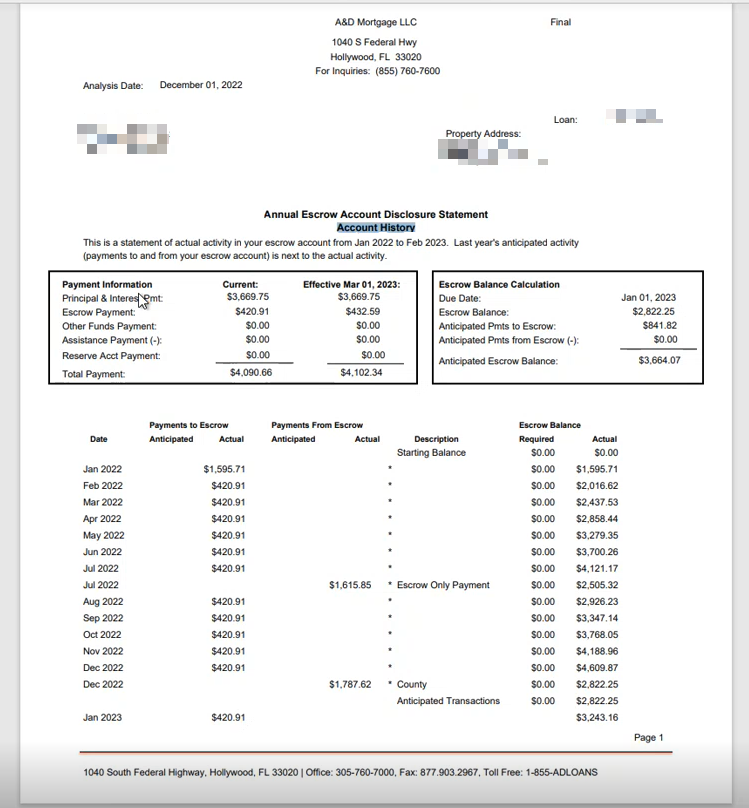

An escrow statement is an annual report provided by your lender detailing the funds held in your escrow account. The statement includes a history of the past year’s payments and a projection of the upcoming year’s anticipated payments and disbursements.

Key Escrow Statement Information

- Account History: This section shows a chronological breakdown of the payments made to and disbursements made from the escrow account.

- Escrow Balance Calculation: This section calculates the anticipated and actual escrow balance.

- Payment Information: This section provides details about the current principal, interest, and escrow payment amounts, as well as the effective date of any changes.

- Payments to Escrow: This section details all the payments made into the escrow account, including dates, anticipated amounts, and actual amounts.

- Payments From Escrow: This shows the disbursements made from the escrow account, such as property tax payments or insurance premiums.

- Escrow Balance: This column tracks the running balance of the escrow account after each transaction.

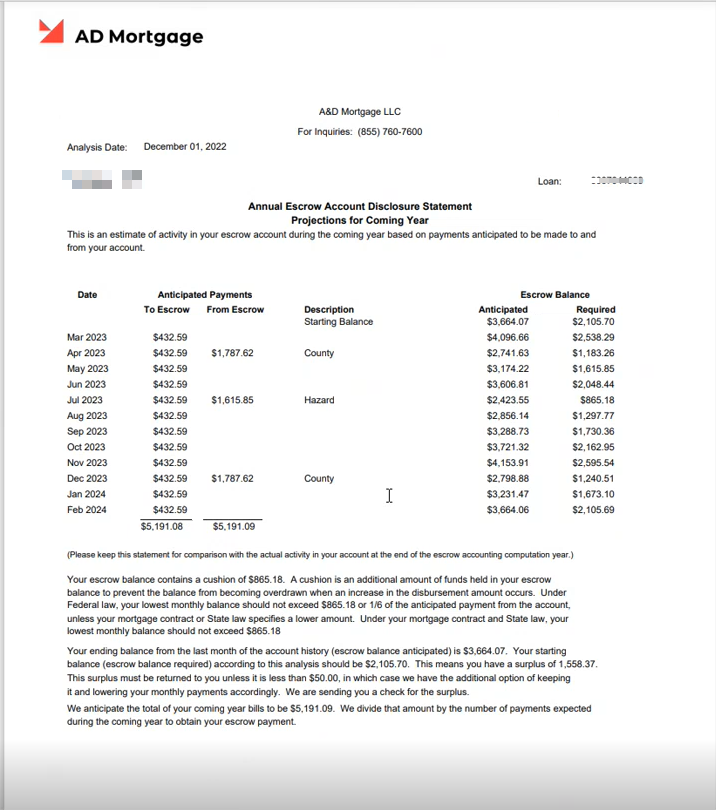

- Projections: This section shows the anticipated payments to and from the escrow account for the coming year.

- Anticipated Payments: This shows the projected amount you’ll be paying into the escrow account each month.

- Escrow Balance: This shows the projected balance of your escrow account at the end of each month. This balance takes into account the anticipated payments, disbursements, and any surplus or shortage in the account.

- Surplus/Shortage: This section provides information about any surplus or shortage in the account.

What to Watch for on Your Escrow Statement

Escrow Balance: Ensure the balance is sufficient to cover upcoming property tax and insurance payments. A low balance could lead to penalties or lapses in coverage.

Escrow Payment Amount: Check if the current payment aligns with your budget and if it’s sufficient to maintain a healthy escrow balance.

Payment History: Review the payment history to verify that all payments were made on time and in the correct amounts.

Disbursements: Confirm that payments were made to the correct entities and that the amounts match what was expected.

Anticipated Transactions: Pay attention to any upcoming transactions that might impact your escrow balance.

Projections: Review the projections to see if the anticipated payments and disbursements are accurate.

Surplus/Shortage: If there is a surplus, make sure that it is returned to you. If there is a shortage, make sure that you are aware of the additional payments that you need to make.

Conclusion

Escrow accounts are essential tools that help you manage the often-overlooked costs associated with property taxes and homeowners insurance. While they offer valuable convenience and security, they also require careful attention to avoid surprises. By understanding how escrow accounts work, reviewing statements regularly, and staying aware of potential shortages and overages, you’ll feel more confident in managing your mortgage payments.

If you have any questions or concerns about your escrow account, it’s important to contact your lender or mortgage servicer for clarification.